Self Verification: Building a Cross-Country Security Layer

Industry

Digital Banking

Client

Nubank

Focus Area

Platform Design

Timeline

2023

Industry

Digital Banking

Client

Nubank

Focus Area

Platform Design

Timeline

2023

1. Overview

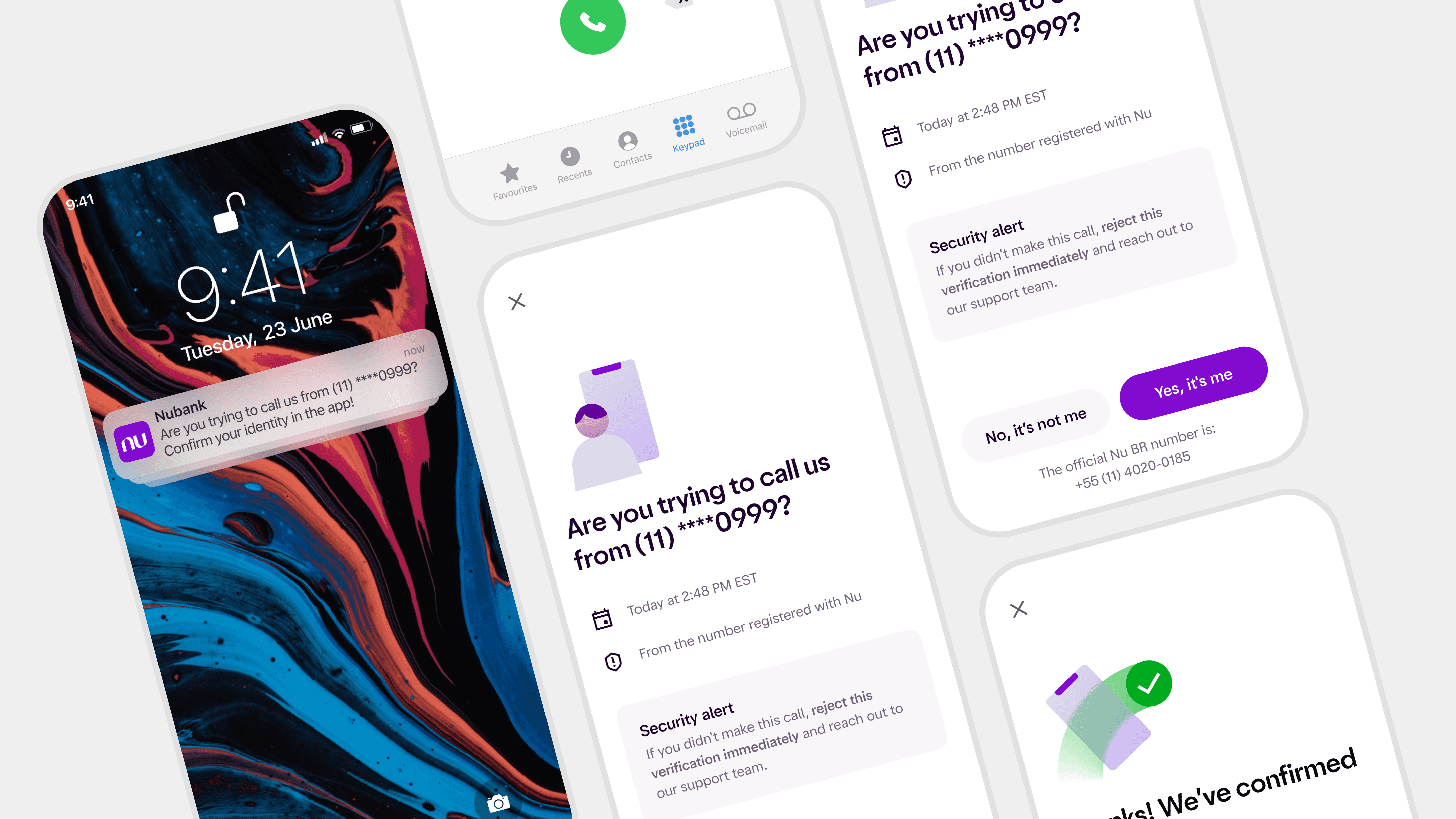

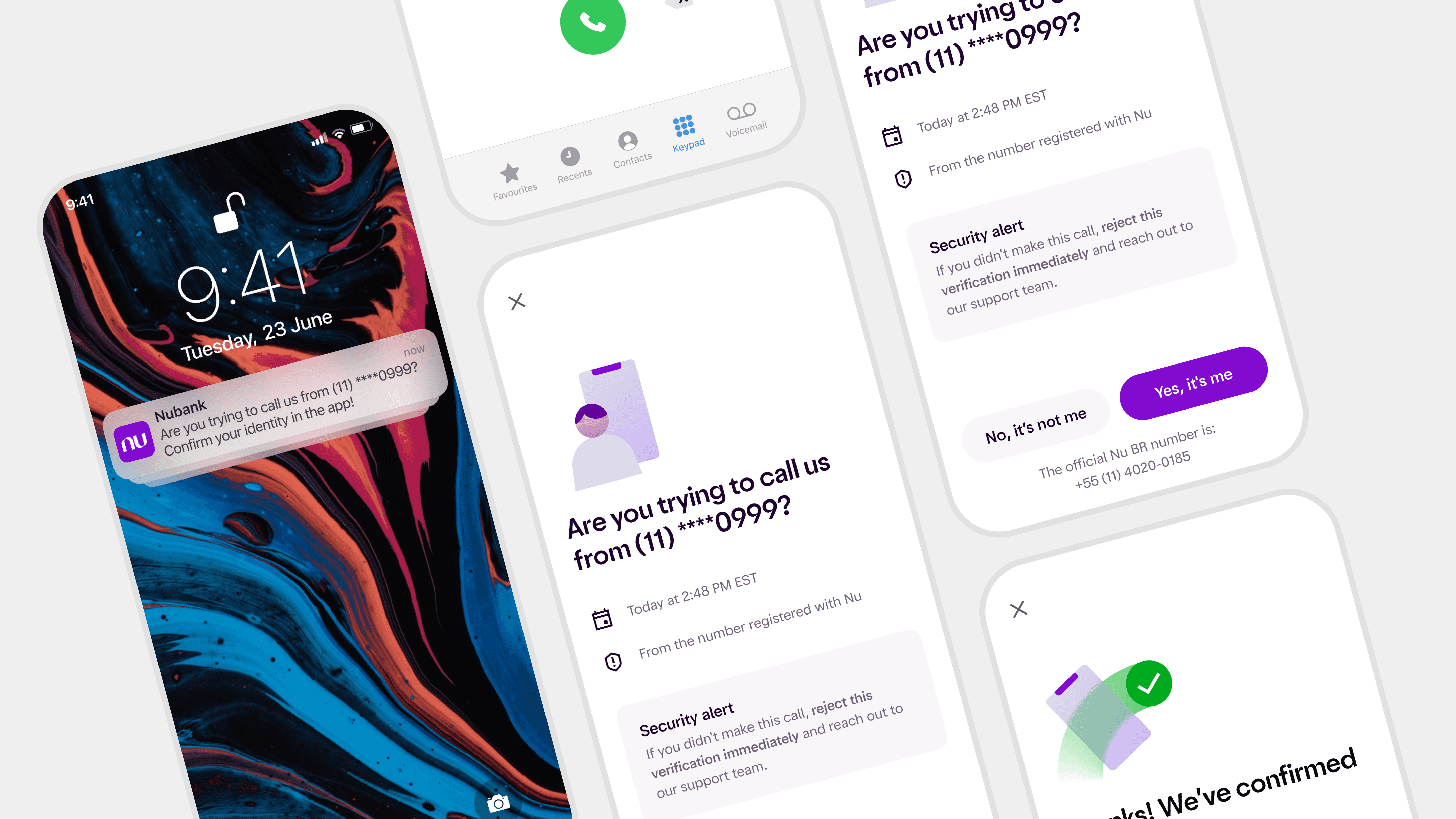

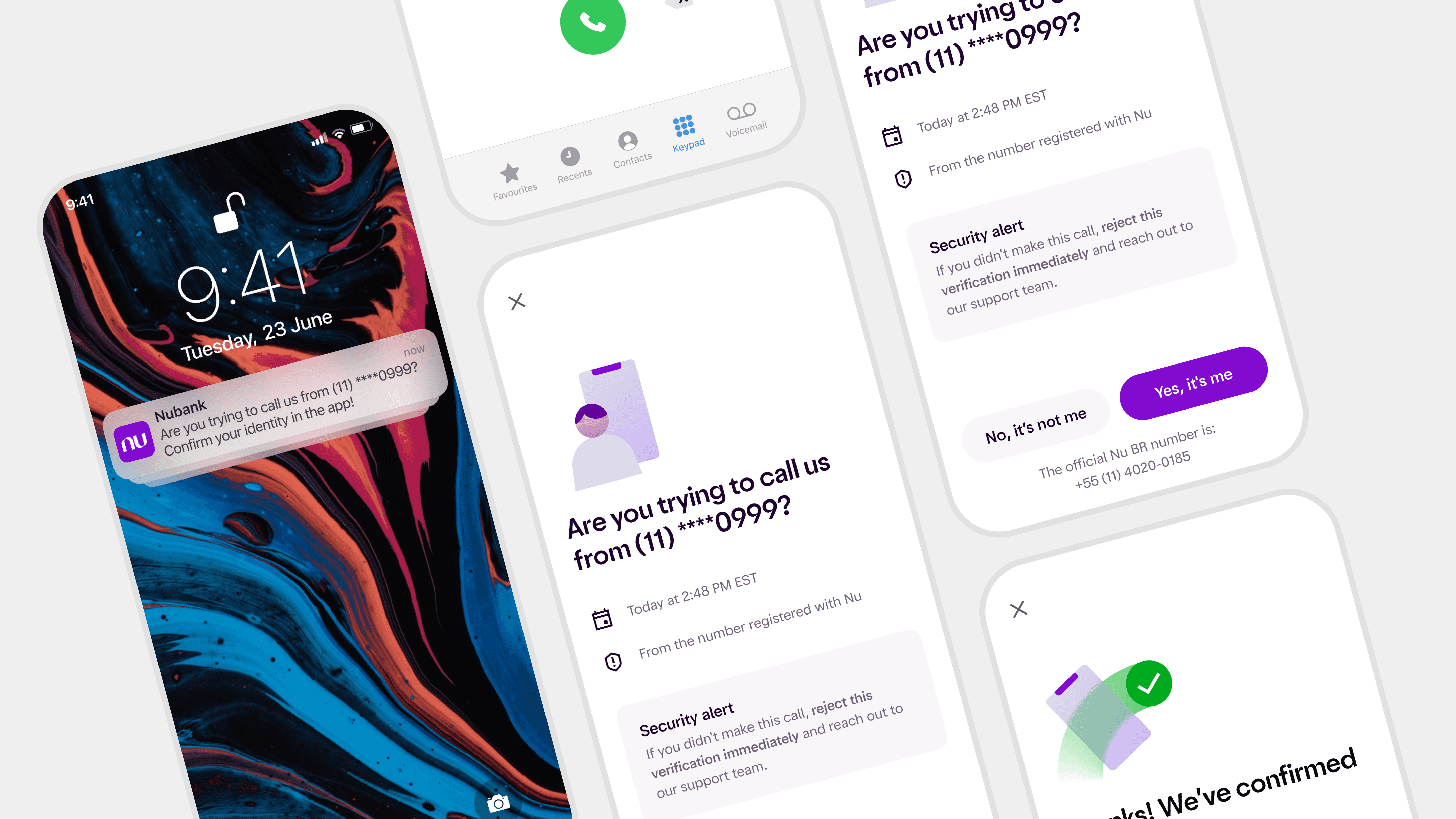

For years, phone authentication at Nubank relied heavily on manual questioning by agents. Customers were asked to confirm personal information while already stressed, frustrated, or dealing with urgent financial issues.

The process was slow, inconsistent, and increasingly vulnerable to fraud and social engineering. As call volumes grew across Latin America, manual verification became one of the most fragile parts of the support operation.

This case describes how we designed Self Verification: a secure, app-based identity layer that shifted authentication from human interrogation to digital confirmation, enabling scalable, multi-country verification infrastructure.

For years, phone authentication at Nubank relied heavily on manual questioning by agents. Customers were asked to confirm personal information while already stressed, frustrated, or dealing with urgent financial issues.

The process was slow, inconsistent, and increasingly vulnerable to fraud and social engineering. As call volumes grew across Latin America, manual verification became one of the most fragile parts of the support operation.

This case describes how we designed Self Verification: a secure, app-based identity layer that shifted authentication from human interrogation to digital confirmation, enabling scalable, multi-country verification infrastructure.

For years, phone authentication at Nubank relied heavily on manual questioning by agents. Customers were asked to confirm personal information while already stressed, frustrated, or dealing with urgent financial issues.

The process was slow, inconsistent, and increasingly vulnerable to fraud and social engineering. As call volumes grew across Latin America, manual verification became one of the most fragile parts of the support operation.

This case describes how we designed Self Verification: a secure, app-based identity layer that shifted authentication from human interrogation to digital confirmation, enabling scalable, multi-country verification infrastructure.

How do we move identity verification from fragile human processes to secure digital infrastructure across countries?

2. Strategic Context

As call volumes grew across Latin America, manual verification became one of the most fragile operational components. It generated:

High exposure of sensitive data

Long handling times (40–90s)

Inconsistent security standards

High training costs

Fraud vulnerability

Meanwhile, the Nubank app already supported secure authentication. The strategic opportunity was to extend this trust infrastructure to the phone channel.

As call volumes grew across Latin America, manual verification became one of the most fragile operational components. It generated:

High exposure of sensitive data

Long handling times (40–90s)

Inconsistent security standards

High training costs

Fraud vulnerability

Meanwhile, the Nubank app already supported secure authentication. The strategic opportunity was to extend this trust infrastructure to the phone channel.

As call volumes grew across Latin America, manual verification became one of the most fragile operational components. It generated:

High exposure of sensitive data

Long handling times (40–90s)

Inconsistent security standards

High training costs

Fraud vulnerability

Meanwhile, the Nubank app already supported secure authentication. The strategic opportunity was to extend this trust infrastructure to the phone channel.

3. Role & Scope

My central responsibility was ensuring that security improvements translated into usable, trustworthy experiences. Responsibilities:

Designing cross-channel authentication journeys

Defining interaction patterns between phone and app

Structuring experimentation frameworks

Coordinating with Fraud, Risk, Legal, and Engineering

Adapting flows for Brazil, Mexico, and Colombia

Establishing success and guardrail metrics

My central responsibility was ensuring that security improvements translated into usable, trustworthy experiences. Responsibilities:

Designing cross-channel authentication journeys

Defining interaction patterns between phone and app

Structuring experimentation frameworks

Coordinating with Fraud, Risk, Legal, and Engineering

Adapting flows for Brazil, Mexico, and Colombia

Establishing success and guardrail metrics

My central responsibility was ensuring that security improvements translated into usable, trustworthy experiences. Responsibilities:

Designing cross-channel authentication journeys

Defining interaction patterns between phone and app

Structuring experimentation frameworks

Coordinating with Fraud, Risk, Legal, and Engineering

Adapting flows for Brazil, Mexico, and Colombia

Establishing success and guardrail metrics

“He designed verification systems that were intuitive for both customers and operations teams, reducing training needs and increasing security.”

Operations Manager

5. Trade-offs & Decisions

Security vs Accessibility

Digital-first verification improved security but risked excluding users without reliable app access. Overly strict enforcement would increase abandonment. We designed structured fallback routes to balance protection and inclusion.

Critical Trade-offs

Digital-first vs Inclusivity

Speed vs Fraud Resistance

Standardization vs Localization

Missteps & Corrections

Early MVPs showed low engagement and confusion around instructions.

We redesigned prompts, simplified flows, and adjusted timing.

Regional friction required further adaptation.

Security vs Accessibility

Digital-first verification improved security but risked excluding users without reliable app access. Overly strict enforcement would increase abandonment. We designed structured fallback routes to balance protection and inclusion.

Critical Trade-offs

Digital-first vs Inclusivity

Speed vs Fraud Resistance

Standardization vs Localization

Missteps & Corrections

Early MVPs showed low engagement and confusion around instructions.

We redesigned prompts, simplified flows, and adjusted timing.

Regional friction required further adaptation.

Security vs Accessibility

Digital-first verification improved security but risked excluding users without reliable app access. Overly strict enforcement would increase abandonment. We designed structured fallback routes to balance protection and inclusion.

Critical Trade-offs

Digital-first vs Inclusivity

Speed vs Fraud Resistance

Standardization vs Localization

Missteps & Corrections

Early MVPs showed low engagement and confusion around instructions.

We redesigned prompts, simplified flows, and adjusted timing.

Regional friction required further adaptation.

7. Experimentation

From MVP to maturity

We launched Self Verification through successive experimental phases.

MVP: BrazilInitial pilots focused on validating behavioral adoption. Results:

~30% engagement

No negative impact on satisfaction

18-second average handling time reduction

R$2.6M annual savings potential

These signals justified national rollout.

V1: Security stress tests

As adoption grew, we expanded challenge mechanisms and stress-tested fraud resilience. Initial results revealed increased friction and drop-offs. Rather than abandoning the system, we redesigned interaction pacing and fallback logic.

V2: Engagement optimization

Engagement plateaued around 34%. We ran multi-armed experiments testing:

Announcement framing

Audio scripts

Fallback timing

Automatic drop logic

Best-performing variants increased engagement by more than 10 percentage points.

Multi-country expansion: Designing for regulation

Scaling to Mexico and Colombia introduced new regulatory constraints. Mexican regulations required stronger authentication categories and additional password-based validation.

We redesigned the platform to support country-specific rules without fragmenting the experience. This involved:

Localized scripts (Spanish and Portuguese)

Regulatory alignment

Market-specific fallback logic

Legal review cycles

The result was a reusable framework adaptable across geographies.

Content and voice design

Security experiences are strongly shaped by language. I led the definition of IVR scripts and in-app copy, balancing:

Authority

Emotional reassurance

Actionability

Cultural adaptation

Standardized voice and screen systems reduced confusion and increased compliance.

From MVP to maturity

We launched Self Verification through successive experimental phases.

MVP: BrazilInitial pilots focused on validating behavioral adoption. Results:

~30% engagement

No negative impact on satisfaction

18-second average handling time reduction

R$2.6M annual savings potential

These signals justified national rollout.

V1: Security stress tests

As adoption grew, we expanded challenge mechanisms and stress-tested fraud resilience. Initial results revealed increased friction and drop-offs. Rather than abandoning the system, we redesigned interaction pacing and fallback logic.

V2: Engagement optimization

Engagement plateaued around 34%. We ran multi-armed experiments testing:

Announcement framing

Audio scripts

Fallback timing

Automatic drop logic

Best-performing variants increased engagement by more than 10 percentage points.

Multi-country expansion: Designing for regulation

Scaling to Mexico and Colombia introduced new regulatory constraints. Mexican regulations required stronger authentication categories and additional password-based validation.

We redesigned the platform to support country-specific rules without fragmenting the experience. This involved:

Localized scripts (Spanish and Portuguese)

Regulatory alignment

Market-specific fallback logic

Legal review cycles

The result was a reusable framework adaptable across geographies.

Content and voice design

Security experiences are strongly shaped by language. I led the definition of IVR scripts and in-app copy, balancing:

Authority

Emotional reassurance

Actionability

Cultural adaptation

Standardized voice and screen systems reduced confusion and increased compliance.

From MVP to maturity

We launched Self Verification through successive experimental phases.

MVP: BrazilInitial pilots focused on validating behavioral adoption. Results:

~30% engagement

No negative impact on satisfaction

18-second average handling time reduction

R$2.6M annual savings potential

These signals justified national rollout.

V1: Security stress tests

As adoption grew, we expanded challenge mechanisms and stress-tested fraud resilience. Initial results revealed increased friction and drop-offs. Rather than abandoning the system, we redesigned interaction pacing and fallback logic.

V2: Engagement optimization

Engagement plateaued around 34%. We ran multi-armed experiments testing:

Announcement framing

Audio scripts

Fallback timing

Automatic drop logic

Best-performing variants increased engagement by more than 10 percentage points.

Multi-country expansion: Designing for regulation

Scaling to Mexico and Colombia introduced new regulatory constraints. Mexican regulations required stronger authentication categories and additional password-based validation.

We redesigned the platform to support country-specific rules without fragmenting the experience. This involved:

Localized scripts (Spanish and Portuguese)

Regulatory alignment

Market-specific fallback logic

Legal review cycles

The result was a reusable framework adaptable across geographies.

Content and voice design

Security experiences are strongly shaped by language. I led the definition of IVR scripts and in-app copy, balancing:

Authority

Emotional reassurance

Actionability

Cultural adaptation

Standardized voice and screen systems reduced confusion and increased compliance.

8. Impact

At maturity, Self Verification became foundational infrastructure. Key outcomes:

Millions of automated verifications

Multi-country deployment

Significant reduction in manual questioning

Lower fraud exposure

Multi-million BRL operational savings

Reduced average handling time across priority flows

Verification evolved from cost center to efficiency lever.

At maturity, Self Verification became foundational infrastructure. Key outcomes:

Millions of automated verifications

Multi-country deployment

Significant reduction in manual questioning

Lower fraud exposure

Multi-million BRL operational savings

Reduced average handling time across priority flows

Verification evolved from cost center to efficiency lever.

At maturity, Self Verification became foundational infrastructure. Key outcomes:

Millions of automated verifications

Multi-country deployment

Significant reduction in manual questioning

Lower fraud exposure

Multi-million BRL operational savings

Reduced average handling time across priority flows

Verification evolved from cost center to efficiency lever.