AI Conversational Partner: From Vision to Infrastructure

Industry

Digital Banking

Client

Nubank

Focus Area

AI Systems

Timeline

2025

Industry

Digital Banking

Client

Nubank

Focus Area

AI Systems

Timeline

2025

1. Overview

By 2025, Nubank’s conversational ecosystem had reached an inflection point.

Chat support, Pix automation, insights surfaces, and emerging AI features were evolving independently. Each initiative solved a local problem, but together they formed a fragmented landscape: multiple entry points, inconsistent behaviors, duplicated patterns, and unclear ownership.

At the same time, Nubank’s AI ambitions were accelerating. The company launched the Private Banker initiative to define the future of AI as a consumer-facing financial partner, unifying assistance, advice, and support into a single conversational layer.

I was one of four designers selected for the cross-functional taskforce responsible for shaping that long-term vision. After presenting the strategy to executive leadership in Q3 2025, the proposal was not only approved, it was accelerated.

This case describes how we translated vision into platform foundations.

By 2025, Nubank’s conversational ecosystem had reached an inflection point.

Chat support, Pix automation, insights surfaces, and emerging AI features were evolving independently. Each initiative solved a local problem, but together they formed a fragmented landscape: multiple entry points, inconsistent behaviors, duplicated patterns, and unclear ownership.

At the same time, Nubank’s AI ambitions were accelerating. The company launched the Private Banker initiative to define the future of AI as a consumer-facing financial partner, unifying assistance, advice, and support into a single conversational layer.

I was one of four designers selected for the cross-functional taskforce responsible for shaping that long-term vision. After presenting the strategy to executive leadership in Q3 2025, the proposal was not only approved, it was accelerated.

This case describes how we translated vision into platform foundations.

By 2025, Nubank’s conversational ecosystem had reached an inflection point.

Chat support, Pix automation, insights surfaces, and emerging AI features were evolving independently. Each initiative solved a local problem, but together they formed a fragmented landscape: multiple entry points, inconsistent behaviors, duplicated patterns, and unclear ownership.

At the same time, Nubank’s AI ambitions were accelerating. The company launched the Private Banker initiative to define the future of AI as a consumer-facing financial partner, unifying assistance, advice, and support into a single conversational layer.

I was one of four designers selected for the cross-functional taskforce responsible for shaping that long-term vision. After presenting the strategy to executive leadership in Q3 2025, the proposal was not only approved, it was accelerated.

This case describes how we translated vision into platform foundations.

How do we transform fragmented conversational features into a unified AI platform to be adopted company-wide?

2. Strategic Context

Before Private Banker, Nubank’s conversational touchpoints were growing organically:

Support chat flows

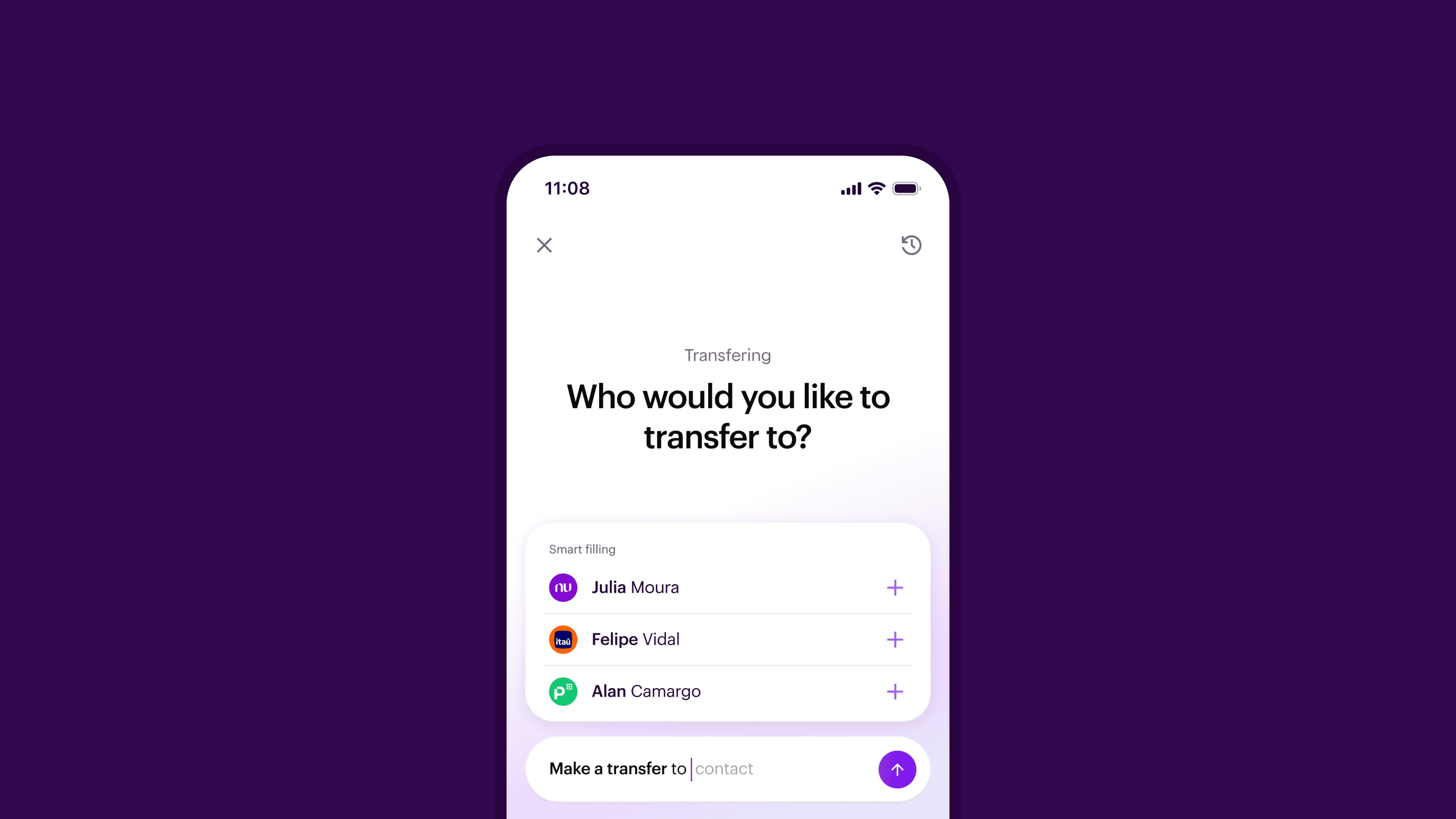

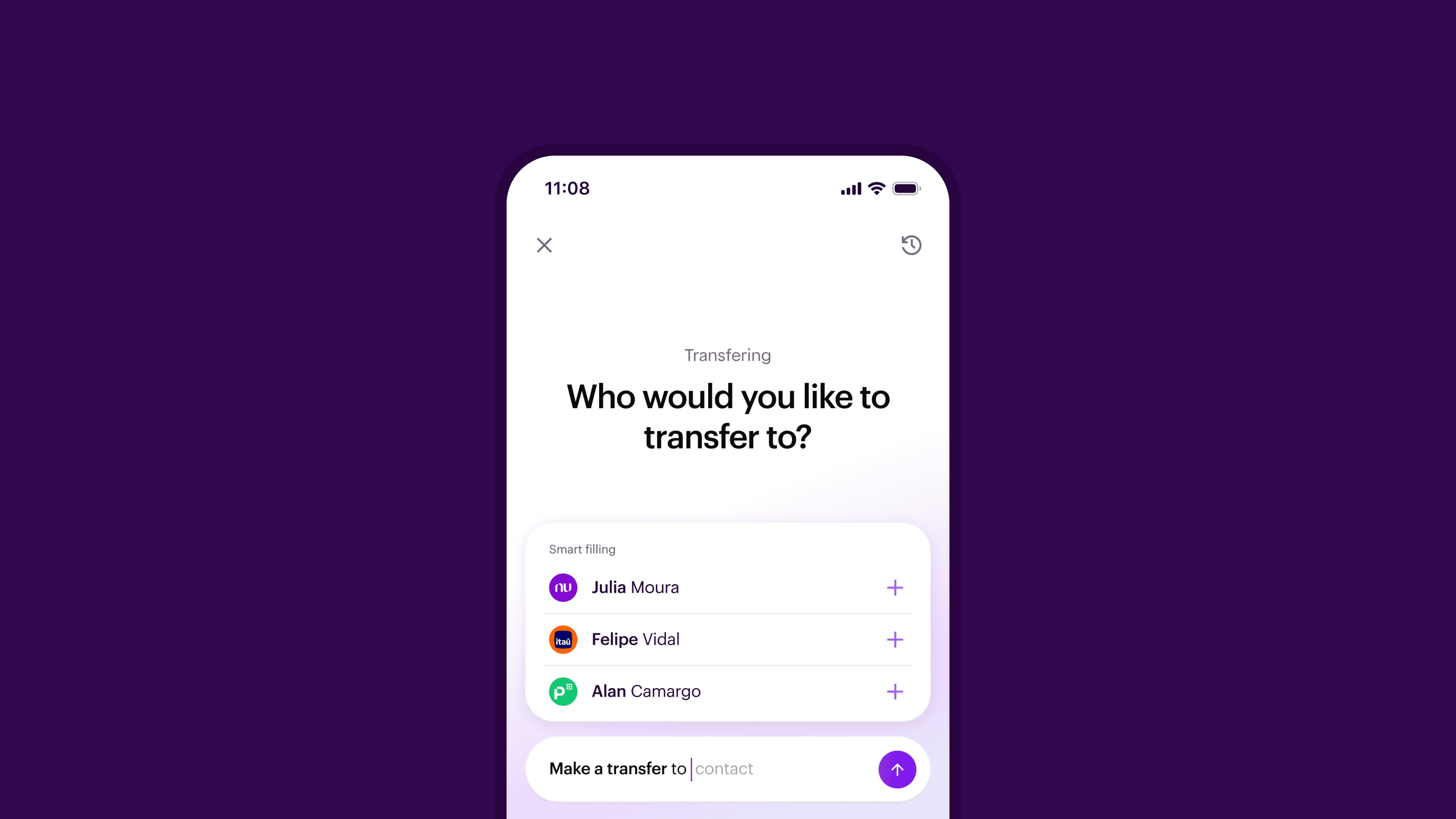

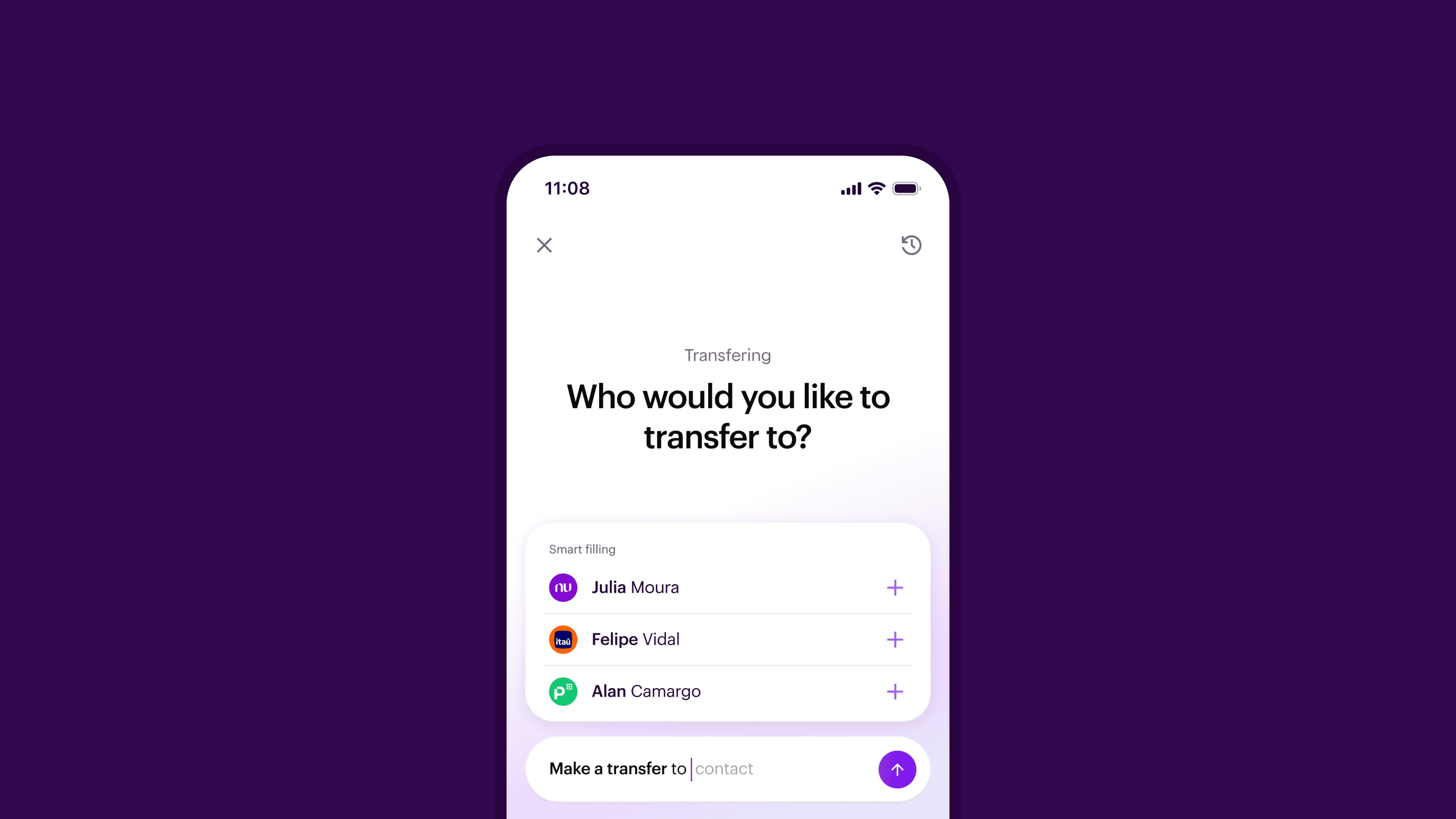

AI-powered Pix journeys

Insights experiences

Domain-specific conversational tools

From a user perspective, this created friction:

Inconsistent interaction patterns

Confusion about capabilities

Disjointed escalation paths

Redundant conversational structures

From an organizational perspective, it created design debt and slowed AI expansion.

Before Private Banker, Nubank’s conversational touchpoints were growing organically:

Support chat flows

AI-powered Pix journeys

Insights experiences

Domain-specific conversational tools

From a user perspective, this created friction:

Inconsistent interaction patterns

Confusion about capabilities

Disjointed escalation paths

Redundant conversational structures

From an organizational perspective, it created design debt and slowed AI expansion.

Before Private Banker, Nubank’s conversational touchpoints were growing organically:

Support chat flows

AI-powered Pix journeys

Insights experiences

Domain-specific conversational tools

From a user perspective, this created friction:

Inconsistent interaction patterns

Confusion about capabilities

Disjointed escalation paths

Redundant conversational structures

From an organizational perspective, it created design debt and slowed AI expansion.

3. Role & Scope

I was one of four designers in the taskforce and became a primary contributor to the foundational layer. My scope included:

Vision articulation

Platform primitives

Conversation stages

Governance models

Cross-BU collaboration

I was one of four designers in the taskforce and became a primary contributor to the foundational layer. My scope included:

Vision articulation

Platform primitives

Conversation stages

Governance models

Cross-BU collaboration

I was one of four designers in the taskforce and became a primary contributor to the foundational layer. My scope included:

Vision articulation

Platform primitives

Conversation stages

Governance models

Cross-BU collaboration

“He led ambiguous initiatives and translated vision into scalable experiences adopted across multiple products.”

Senior Product Manager

5. Trade-offs & Decisions

Vision vs Feasibility

After executive approval, the roadmap was accelerated so we had to translate a 12–18 month vision into near-term delivery without compromising architecture.

Critical Trade-offs

Speed vs Architectural Integrity

Customization vs Standardization

Autonomy vs Central Governance

Missteps & Corrections

Early abstractions left ownership gaps and duplicated logic then we clarified governance and documentation.

Vision vs Feasibility

After executive approval, the roadmap was accelerated so we had to translate a 12–18 month vision into near-term delivery without compromising architecture.

Critical Trade-offs

Speed vs Architectural Integrity

Customization vs Standardization

Autonomy vs Central Governance

Missteps & Corrections

Early abstractions left ownership gaps and duplicated logic then we clarified governance and documentation.

Vision vs Feasibility

After executive approval, the roadmap was accelerated so we had to translate a 12–18 month vision into near-term delivery without compromising architecture.

Critical Trade-offs

Speed vs Architectural Integrity

Customization vs Standardization

Autonomy vs Central Governance

Missteps & Corrections

Early abstractions left ownership gaps and duplicated logic then we clarified governance and documentation.

7. Experimentation

Accelerating the roadmap: P0 and P1

To balance ambition and feasibility, we structured delivery into phases:

P0: Foundational infrastructure

P1: Core agents and high-priority journeys

P2+: Advanced personalization and advisory layers

This roadmap allowed multiple BUs to contribute without compromising architectural coherence. The result was faster AI onboarding across teams and reduced duplication of effort.

Accelerating the roadmap: P0 and P1

To balance ambition and feasibility, we structured delivery into phases:

P0: Foundational infrastructure

P1: Core agents and high-priority journeys

P2+: Advanced personalization and advisory layers

This roadmap allowed multiple BUs to contribute without compromising architectural coherence. The result was faster AI onboarding across teams and reduced duplication of effort.

Accelerating the roadmap: P0 and P1

To balance ambition and feasibility, we structured delivery into phases:

P0: Foundational infrastructure

P1: Core agents and high-priority journeys

P2+: Advanced personalization and advisory layers

This roadmap allowed multiple BUs to contribute without compromising architectural coherence. The result was faster AI onboarding across teams and reduced duplication of effort.

8. Impact

Private Banker changed how teams approached conversation design. Instead of asking, “Can this feature use chat?”, teams began asking, “How does this integrate into the platform?”. Outcomes included:

Reduced design fragmentation

Accelerated AI experimentation

Improved cross-BU collaboration

Created a shared language around conversation design

Established reusable standards adopted company-wide

The platform became the reference architecture for conversational products.

Private Banker changed how teams approached conversation design. Instead of asking, “Can this feature use chat?”, teams began asking, “How does this integrate into the platform?”. Outcomes included:

Reduced design fragmentation

Accelerated AI experimentation

Improved cross-BU collaboration

Created a shared language around conversation design

Established reusable standards adopted company-wide

The platform became the reference architecture for conversational products.

Private Banker changed how teams approached conversation design. Instead of asking, “Can this feature use chat?”, teams began asking, “How does this integrate into the platform?”. Outcomes included:

Reduced design fragmentation

Accelerated AI experimentation

Improved cross-BU collaboration

Created a shared language around conversation design

Established reusable standards adopted company-wide

The platform became the reference architecture for conversational products.